Valuation Multiples - Using LTM vs NTM Multiples in Valuation

Par un écrivain mystérieux

Last updated 07 juin 2024

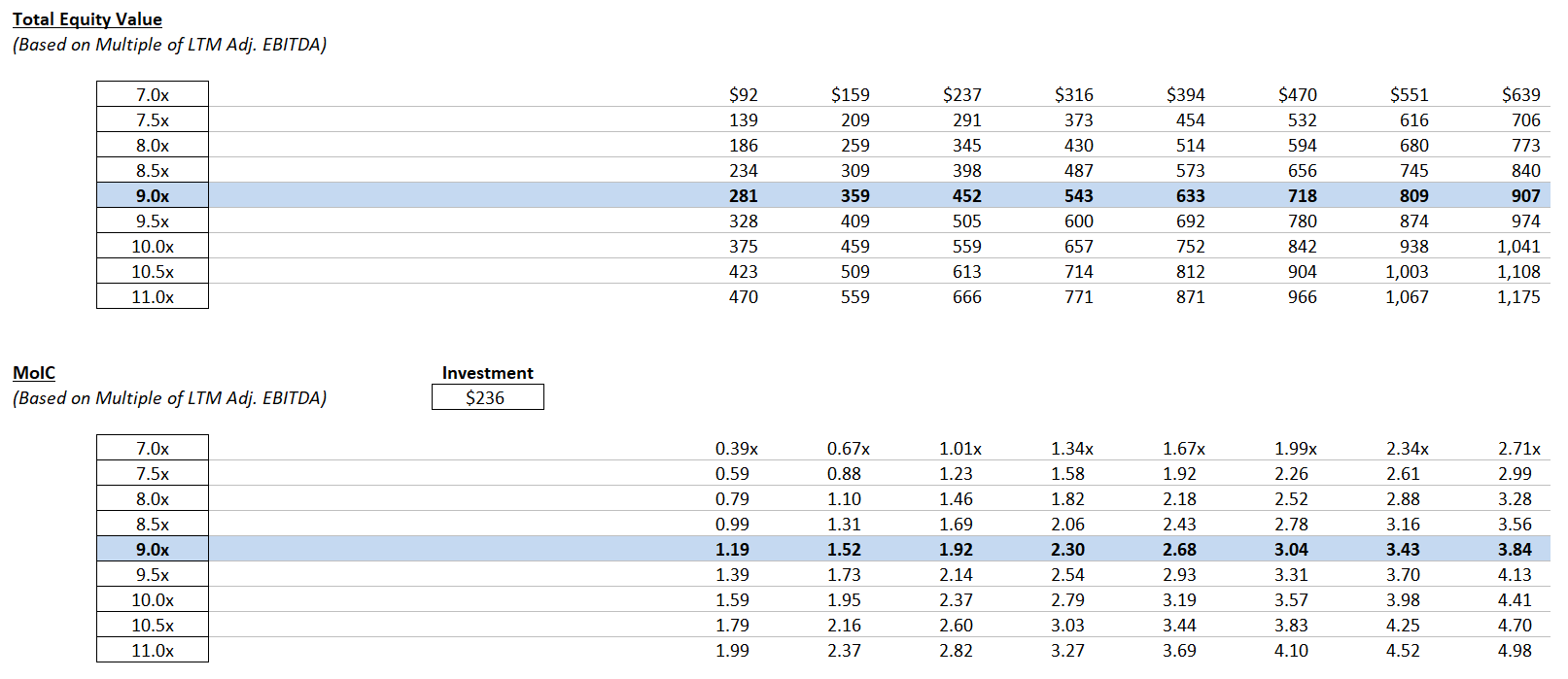

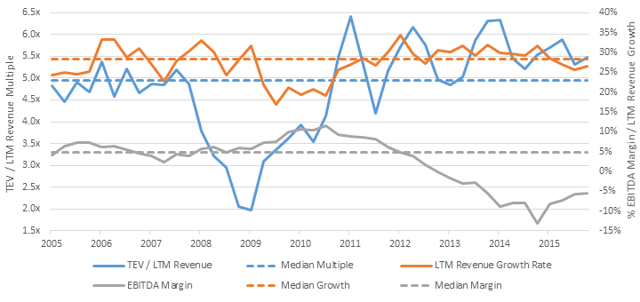

Financial analysts use LTM vs. NTM in looking at corporate deals, which serves as one of the fastest ways of valuing a business.

Multiple Expansion

Public Comps Weekly Update - 2022.06.21

:max_bytes(150000):strip_icc()/EnterpriseValuetoRevenueMultiple-5074c273913b4c49946f9f8df23af8a8.png)

Enterprise-Value-to-Revenue Multiple (EV/R): Definition

SaaS Investors: Mind The Valuation 'GAP' (Growth At Any Price

SUV Report - ScaleUp Views - U.S. Enterprise Software

The most ambiguous term in startup land

NTM Meaning in Finance: Explained With Case Studies - Finance Detailed

Rule of 40 Archives - Kellblog

Valuation Multiples - Using LTM vs NTM Multiples in Valuation

Thorsten Claus: Cloud Index: EBITDA Margins versus Revenue Growth

LTM Revenue (and EBITDA) in 3 Steps - The Ultimate Guide (2021)

Recommandé pour vous

Suprême NTM - Wikipedia14 Jul 2023

Suprême NTM - Wikipedia14 Jul 2023 Suprême NTM - Suprême NTM - Chronique - Abcdr du Son14 Jul 2023

Suprême NTM - Suprême NTM - Chronique - Abcdr du Son14 Jul 2023 Suprême NTM Discography14 Jul 2023

Suprême NTM Discography14 Jul 2023 SUPRÊME NTM – Base Productions14 Jul 2023

SUPRÊME NTM – Base Productions14 Jul 2023 Vidéo : La première télé de NTM (avec Kool Shen, JoeyStarr et DJ'S14 Jul 2023

Vidéo : La première télé de NTM (avec Kool Shen, JoeyStarr et DJ'S14 Jul 2023 NTM Patient Care UK14 Jul 2023

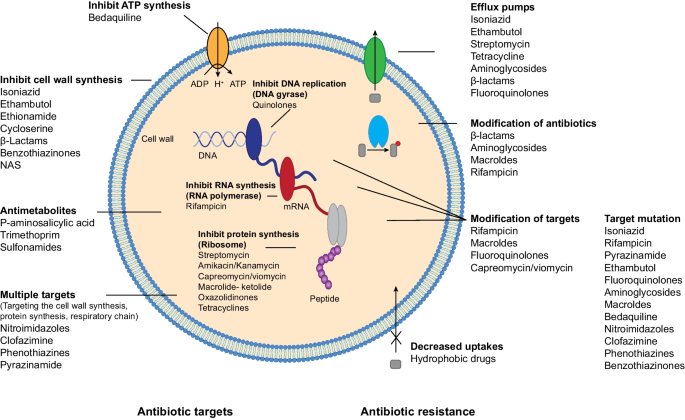

NTM Patient Care UK14 Jul 2023 Meeting the challenges of NTM-PD from the perspective of the14 Jul 2023

Meeting the challenges of NTM-PD from the perspective of the14 Jul 2023 Nontuberculous Mycobacteria (NTM) Infections Mycobacterial14 Jul 2023

Nontuberculous Mycobacteria (NTM) Infections Mycobacterial14 Jul 2023 JoeyStarr à propos de l'expression NTM14 Jul 2023

JoeyStarr à propos de l'expression NTM14 Jul 2023 Arte releases most expensive series ever on French rap legends14 Jul 2023

Arte releases most expensive series ever on French rap legends14 Jul 2023

Tu pourrais aussi aimer

NEGJ 24PC T Shaped Stopper Cork Wine Stopper Bottle Stoppers Reusable Wine Bottle Stopper Sealing Plug Bottle Cap For Wine Bottles14 Jul 2023

NEGJ 24PC T Shaped Stopper Cork Wine Stopper Bottle Stoppers Reusable Wine Bottle Stopper Sealing Plug Bottle Cap For Wine Bottles14 Jul 2023 DÉCORATION TÊTE DE MORT NOIRE RÉSINE 15CM14 Jul 2023

DÉCORATION TÊTE DE MORT NOIRE RÉSINE 15CM14 Jul 2023 Kit de courroie d'accessoire GATES pour Bmw Série 3 5 7 X3 X514 Jul 2023

Kit de courroie d'accessoire GATES pour Bmw Série 3 5 7 X3 X514 Jul 2023 Acheter Whisky Canadien en Ligne14 Jul 2023

Acheter Whisky Canadien en Ligne14 Jul 2023 Pochoir de décoration - Couronne14 Jul 2023

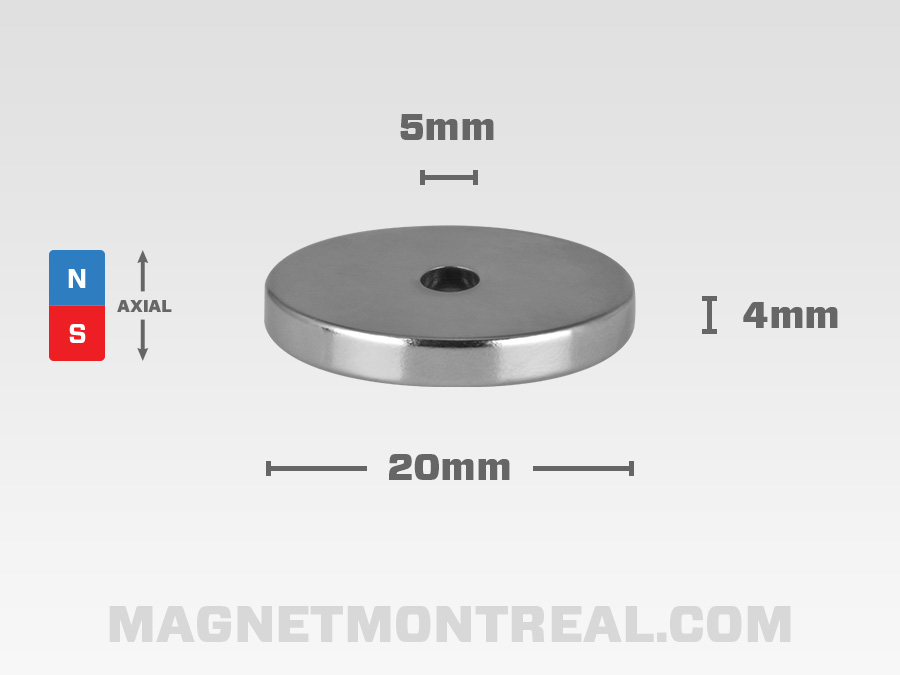

Pochoir de décoration - Couronne14 Jul 2023 Aimant cylindrique au Néodymium avec trou 20mm large x 5mm d'épaisseur (0.79 x 0.2) - Magnet Montréal14 Jul 2023

Aimant cylindrique au Néodymium avec trou 20mm large x 5mm d'épaisseur (0.79 x 0.2) - Magnet Montréal14 Jul 2023- The best movie posters of 2016, according to movie poster experts14 Jul 2023

Autoradio CAS-3445.bt + caméra de recul14 Jul 2023

Autoradio CAS-3445.bt + caméra de recul14 Jul 2023 L'avantage du TDAH : ce que vous pensiez être un diagnostic peut être votre meilleur - BON 978039957345314 Jul 2023

L'avantage du TDAH : ce que vous pensiez être un diagnostic peut être votre meilleur - BON 978039957345314 Jul 2023 Pinceau Acrylique Ongles - Pour des Ongles Sublimes – Gleam Paris14 Jul 2023

Pinceau Acrylique Ongles - Pour des Ongles Sublimes – Gleam Paris14 Jul 2023